property tax assistance program california

The state reimburses a part of the property taxes to eligible individuals. The State Controllers Office SCO administers the Property Tax Postponement PTP Program which allows eligible homeowners to postpone payment of current-year property taxes on their primary residence.

The Property Tax Inheritance Exclusion

Property Tax Assistance Program.

. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax Postponement PTP Program was suspended by the legislature for lack of funds at the height of the Great Recession. Property Tax Assistance Program. Volunteer Income Tax Assistance VITA if you.

The program allows homeowners who are seniors blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including 40 percent equity in the home and an annual household income of 45000 or less. The State Controllers Office SCO administers the Property Tax Postponement PTP program which allows eligible homeowners to postpone payment of current-year property taxes on their primary residence. Due to the large volume of referrals applications will be processed in 4-6 weeks.

If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs. 1400 Sacramento CA 95814. Apply now through Fair Entry and your one application can also get you access to additional subsidized programs and services.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Property Tax Assistance Programs Active Duty Military Personnel - Deferred Taxes. If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the.

BOE forms that pertain to State Assessments. Our program opens on June 1 and applications must be submitted by Dec. Public Auction An auction held pursuant to the California Revenue and Taxation Code Section 3691 in which the Department of Treasurer and Tax Collector auctions and sells tax-defaulted properties in its possession.

California Tax Credit Allocation Committee. The State Controllers Office SCO administers the Property Tax Postponement PTP Program which allows eligible homeowners to postpone payment of current year property taxes on their primary residence. 100000 if your combined disposable income is 0 to 30000 Level 1.

If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the increase on your property tax account. A postponement of property taxes is a deferment of current year property taxes that must eventually be repaid. The document has moved here.

Why pay to file your taxes when you can file for FREE through the Volunteer Income Tax Assistance VITA program. Due to the large volume of referrals applications will be processed in 4-6 weeks. Use the VITA site locator tool on the Free Tax Prep Los Angeles website to identify and book an appointment nearest you.

This deferred payment is a lien on the. The State of California administers two programs to assist low-income blind disabled or senior citizens pay property taxes. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older blind or disabled.

CalHFAs Impact On California. View Your Tax Bill. Property Tax Postponement for Senior Citizens Blind or Disabled Persons.

Even if you are not eligible for the Property Tax Assistance. Have experienced an increase in property tax from the previous year. Make 58000 or less generally.

For additional information about the Tax Appeals Assistance Program call the Administrative Analyst in the Taxpayers Rights Advocate Office at 1-916-309-5496 or refer to. A State program offered to senior blind or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria. BOE forms that pertain to Private Railroad Cars.

September 15 2016. Legal Entity Ownership Program LEOP BOE forms that pertain to Special Revenue Districts. Candidates should apply for the program every year.

The program was established in 1967 to provide direct property tax relief to seniors living on a fixed income. The property tax postponement program gives qualified seniors the option of having the state pay all or part of their property taxes until the individual moves sells the property or dies. If have a limited annual income you may defer the property taxes on your house condo or manufactured home.

Are active duty or retired military personnel or a dependent. Pay Your Tax Bill. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

1 Property Tax Postponement. Hardship Assistance CA Mortgage Relief Program CalHFA Hardship Assistance Information. A postponement of property taxes is a deferment of current-year property taxes that must eventually be repaid.

Low-income residents earning less than 13200 annually. Sacramento Headquarters 500 Capitol Mall Ste. Repayment is secured by a lien against the property.

Tax Counseling for the Elderly TCE if youre at least 60 years old. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45810 or less among other requirements. You may qualify for cash back tax.

Welfare and Veterans Organization Exemption. Own no other City of Calgary residential property. If you live in California you can get free tax help from these programs.

It was later expanded to include renters. Homeowner And Renter Assistance. Property Tax Exemption Program.

VITA sites offer free tax help to individuals and households who make 55000 a year or less. Property Tax Assistance for Seniors in California. The Senior Citizens Homeowners and Renters Property Tax Assistance Law program provided a direct grant to qualifying seniors and disabled individuals who owned or rented a residence.

Nevada City CA 95959. State Controller Betty T. The following programs have maximum income levels and have different provisions.

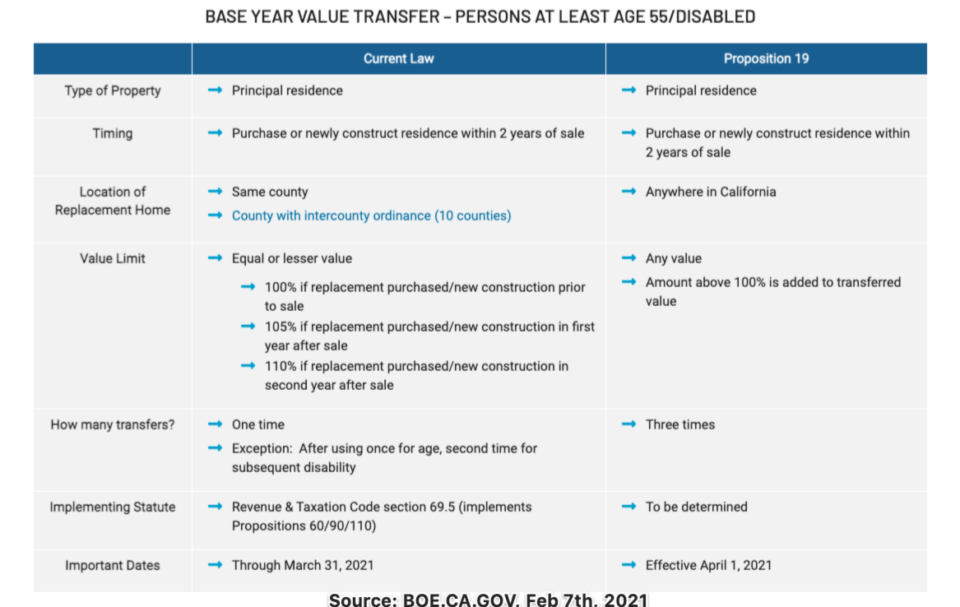

Seniors 62 or older Blind and disabled citizens. The application filing period is October 1 to February 10 of each year. Expanded Property Tax Benefits for Seniors Severely Disabled and Victims of Wildfires or Natural Disasters Starting April 1 2021 Sacramento Today Californias seniors severely disabled persons and victims of wildfires or natural disasters will now be able to transfer the taxable value of their original residence to a replacement residence up to three times during their lifetime.

Our program opens on June 1 and applications must be submitted by Dec. PTP applications are accepted from October 1 to February 10 each year. For information on the States Homeowner or Renter Assistance Program call the Franchise Tax Board at 800 868-4171.

Get free tax help at a location near you. Go to the SCO website at. 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government.

Property Tax Assistance For Blind Disabled or Senior Citizens. Obtain forms from either the County Assessor or the Clerk of the Board in the county where the property is located. From 1978 until the suspension of PTP in 2009 eligible applicants were able to defer payment.

Apply for property tax assistance. Assistance amount will equal the regular and excess property taxes due on the difference between the amount of taxable value exempted under the exemption program and the first. The property tax assistance program provides qualified low-income seniors with cash reimbursements for part of their property taxes.

Hours Monday - Friday 8 am.

Property Tax California H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

Deducting Property Taxes H R Block

Pay Your Property Taxes Treasurer And Tax Collector

Property Taxes By State Embrace Higher Property Taxes

Payment Activity Notice Los Angeles County Property Tax Portal

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida Property Tax H R Block

Notice Of Delinquency Los Angeles County Property Tax Portal

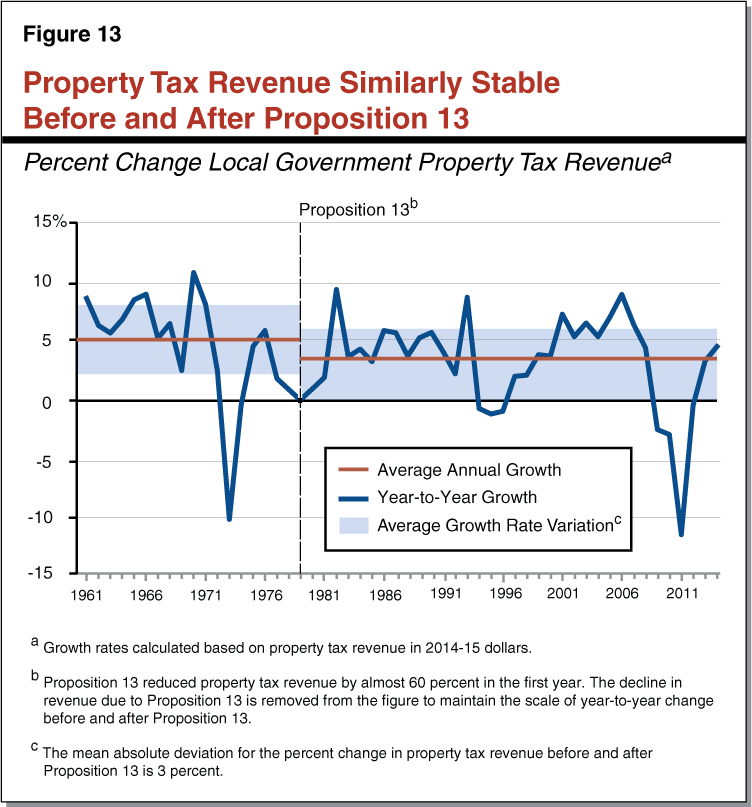

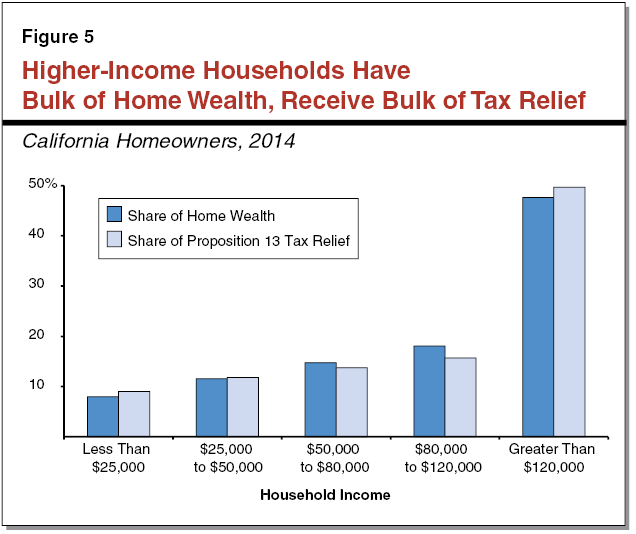

Common Claims About Proposition 13

Property Taxes Department Of Tax And Collections County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What Is A Homestead Exemption California Property Taxes

Property Tax Process Mendocino County Ca

Prop 19 And Property Taxes In California Marc Lyman

Prop 19 And Property Taxes In California Marc Lyman

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal